Scaling up your coaching services

Coaching isn’t defined in the accounting industry as clearly as the likes of accounts preparation or cashflow forecasting.

A clear difference between coaching and other accounting services is that the coach doesn’t need to know the answers… it’s more about the questions they pose.

Common statements about coaching that I’ve come across are – “How is coaching different from giving advice?” or “I don’t know enough about my client’s business” or “I don’t have my own supporting content”.

When coaching your clients, your role is to support, educate and motivate your client to make their business more sustainable and scalable. Questioning your client about the intrinsic strengths of their business and collaborating to find the best path to success is critical, along with providing accountability to ensure incremental change and progress.

To use a cliché analogy – coaching is looking away from the rear-view mirror (or perhaps the reversing camera?) and focusing on the wide windscreen of opportunity ahead.

Why accountants make great coaches:

- They already know what’s ‘under the hood’.

- They are commercial thinkers – spotting the opportunities that lie in numbers!

- They can quickly see their client’s blind spots.

Accountants see vulnerabilities where others can’t, calling near misses from a mile away. Collaborating with your client and shining a light on things they hadn’t noticed provides meaningful opportunities for improvement.

Many of your clients would rather take an ice bath than read their financial statements. They don’t know what they don’t know and they probably own it by saying things like “I‘m not a numbers person”. But we know financial understanding supports better decision-making, and if we don’t help them grow in this area, who will?

What do clients want to be coached on?

It depends on their objectives. Maybe they need you to provide some carrot and stick to ensure progress on a project, perhaps they’re looking to position themselves for succession, or maybe they have a specific issue that needs addressing ASAP, such as poor cash flow. Ultimately, our Gap members are helping their clients achieve one or more of the three freedoms. Not all clients want growth – some just want their weekends back!

For your clients, simply having access to a regular sounding board is likely to be of massive value. Coaching combines your client’s operational knowledge with your commercial expertise. The combined result is greater than the sum of its parts; in other words 1 + 1 = 5.

Regardless of their objectives, leveraging a robust framework that provides reflection, insight, guidance, and accountability ensures the scalability of your coaching service and the resulting success of your clients.

What does the coaching process look like?

1. They’ll sign a proposal.

Our coaching proposals detail the important stuff like their objectives, measure of success, and deliverables, all crafted in "what’s in it for me" language. The frequency of sessions will depend on need and appetite. However, the process is the same.

2. Your client will complete pre-work prior to each session.

This ensures a higher level of thinking and engagement. It gets them to do the heavy lifting before the session and brings you up to speed with their progress and blockers so you can adequately prepare.

In The Gap, we’ve built many specific pre-work forms for your clients to complete easily via a web link in an email.

Use pre-work to ask questions such as "What did you do well last quarter? What could you do differently?", "What do you need to STOP / CONTINUE / START doing next quarter?"

These questions keep the client focused on what’s important and drive the agenda for each session. For example, our cashflow management service aims to solve deep-seated cashflow issues. There’s pre-work for each of the seven key causes of poor cashflow. The pre-work for accounts receivable gathers crucial discussion points related to the client’s Terms of Trade, billing system, debtor process, payment methods, and much more.

3. You’ll prep some resources to discuss as part of the session.

Things like The Achiever Matrix, the OARBED mindset, or one of our auto-branded practical guides, like The Credit Management Guide. These are valuable takeaways for the client (and make you look slick!).

We’ve also got Delivery Notes (for the advisor's eyes only!) and tools/resources to help you prep improvement strategies for discussion in session.

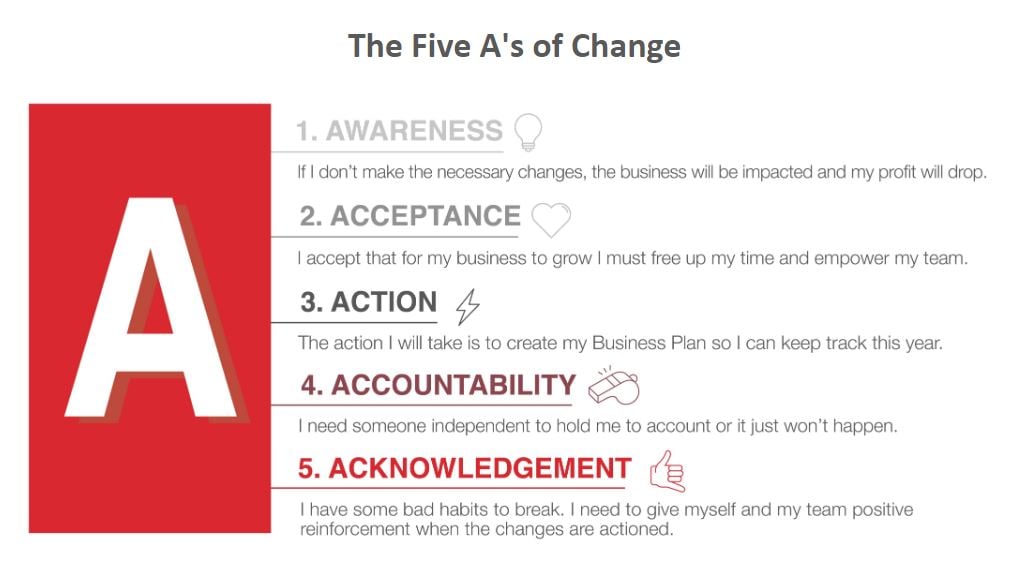

We have over 50 mindsets within The Gap. Becoming an expert on just one or two of these mindsets, and helping your clients do the same, can make a world of difference to coaching outcomes. Consider The 5 A's of Change.

Helping your clients move through the 5 A's will ensure their long-term success.

4. You’ll discuss their pre-work, impart some knowledge, ask some probing questions, and help set actions.

In the session, you’ll discuss the client's pre-work and review their key numbers and progress. You’ll naturally get to the bottom of their blockers, pain points, and new opportunities, and support them to set actions to complete before your next session.

It’s typical for business owners to get sucked into the busy operational stuff and, without an independent coach, ideas won’t materialise on their own.

Asking questions is key for accountability, such as, “How did you get on implementing X & Y?”, “Why didn’t you get around to this?”, “Remind me - why was it important for you to set up invoice reminders?”, “Is cashflow no longer a challenge?”.

These questions may appear confronting, but it’s important to remember that pain is the greatest driver. Helping clients understand the impact of their current (or future) reality creates motivation to take action.

It’s not all stick though – you’ll also get to celebrate their success! When they hit a milestone, don’t be afraid to crack some champagne…!

5. You’ll finalise Meeting Minutes straight after the session.

The Meeting Minutes outline what was discussed and the actions the client agreed to complete between sessions. Our software allows you to seamlessly email a branded PDF record to attendees after each session.

If a client lacks a clear plan, how can they measure their progress?

Coaching can be offered as a service on its own, but after a few sessions following our process, an organic conversation usually eventuates about the importance of having an annual Business Plan to guide both the client’s decisions and the direction of their coaching sessions with you.

We believe best practice in business equals having an annual Business Plan, an annual Forecast, and ongoing reporting and accountability (the coaching part). We find that once our members witness the return on investment for their clients it becomes natural to frame these three services as best practice.

Having a clear understanding of the financial workings of your client’s business is a formidable foundation for coaching.

Add to that your commerciality (some of it absorbed by osmosis during years of accounting), a simple framework for extracting and executing improvement opportunities, and some educational resources, and you’ve got yourself a winning formula to deliver immense value through coaching.

The content within The Gap is expansive, and with our global community, informative Knowledge Base, dedicated member support specialists, and co-founders that live and breathe this stuff, you’ll be supporting your clients as an effective coach as soon as you’re ready to get stuck in.

As Brad Turville, our Business Development Manager in Australia, often says while motioning to his electric guitar in the background – you wouldn’t expect yourself to play like Jimi Hendrix on day one. Every journey starts with a single step, so be brave and put your coaching hat on!

Coaching is a large part of our Five Essential Meetings, check out our resource to find out more about the other essential meetings.